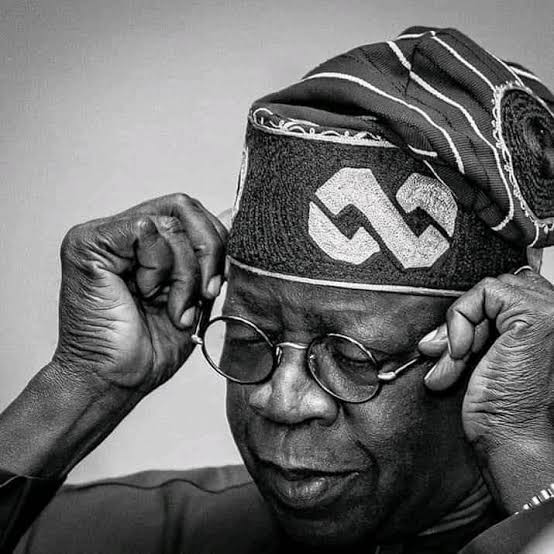

President Bola Ahmed Tinubu was sworn in three months ago and immediately hit the ground running with a raft of bold economic decisions most notably, the removal of fuel subsidy and the floating of the Naira following the unification of the foreign exchange multiple windows of the CBN.

These bold decisions sent strong and clear signals to observers within and outside the country that Nigeria was now ready to deal with its perennial economic demons. The twin steps of fuel subsidy removal and foreign exchange market reforms brought about immediate spike in the cost of living of Nigerians for obvious reasons but crucially, it signalled the commencement of the re-engineering of Africa’s largest but grossly under-developed economy.

At a point within the last decade it became obvious to watchful observers that Nigeria was just trying to get by. Decades of poor economic decisions, mismanagement of resources and lack of structural reforms were beginning to take its toll on the country. The economic disruption occasioned by the low crude oil prices, covid-19 pandemic and East-West cold war that spiralled into the Ukraine conflicts further placed a strain on Nigeria’s economy.

In 2016 when Nigeria inevitably slipped into recession, we had only one choice – spend ourselves out of recession. And spend we did, although mostly through borrowings to fund infrastructure. It was therefore not surprising that despite a low revenue to GDP ratio, Nigeria was still able to spend its away out from recession. Our delicate financial position was made more dire by the fuel subsidy regime even when NNPC was the sole importer and incurring loses on behalf of the Federal Government just ensure PMS is sold at a highly subsidised rate.

Also, due to our great import dependency, lean foreign reserves meant the CBN had to struggle to maintain exchange rate within a stable band. The CBN created multiple windows for trading forex to different segment of buyers such as SMEs window, investors window, manufacturers window as well as the window for invisibles such as school fees, personal and business travel allowances with each selling at different rates. This was invariably meant to manage demand for forex, with the CBN restricting importers of certain items that can be produced locally from accessing forex through the CBN.

This led to a huge differential between the official exchange rate maintained by the CBN and the rate at the Parallel Market. An lucrative avenue for arbitrage was opened. Many called for the unification of the multiple CBN windows and floating of the Naira to close the gap between the official rate and the parallel market rates. The downside with this unification/floating of the Naira was the possibility of significantly increasing the cost of imports due to the resulting devaluation in the event of a float. The potential consequence would be a general rise in consumer prices and inflation.

Not floating has even more dire consequences as it was robbing Nigeria of billions of Naira equivalent of foreign dollar earnings that would have accrued to the federation account if the Naira was floated. The conditions also made currency speculators rich while equally encouraging round tripping and depriving the real sectors of the economy much needed finance from banks who rather lend to round trippers for quick and certain gains.

All these, added to the fuel subsidy conundrum that was now unsustainable because Nigeria was in effect subsidising half of West and Central African countries’ PMS consumption, made the situation a case of a direct choice between the devil and deep blue sea. President Bola Ahmed Tinubu chose to go through the hard but the only reasonable path – subsidy removal and FX windows unification/floating of Naira.

These two policy decisions and other associated policy directions of the Tinubu administration is what I have come to tag as Tinubunomics. In this two-part series, I will attempt to look at the expectations of economic re-engineering from Tinubunomics.

At the heart of Tinubunomics is the quest to restructure Nigeria’s finances. President Bola Tinubu is a fan of making the most out of every dollar Nigeria earns from oil and other exports. His swift end of fuel subsidy immediately removed a huge financial burden from the shoulders of the government.

The floating of the Naira led to a devaluation, which on the upside meant more Naira revenues from Nigeria’s oil exports. From a position of zero remittance by the NNPC Ltd into the federation account, we went to a position where we are now saving more than half of inflows into the federation account for future use and to control inflation. These two major areas however, are by no means Nigeria’s only problems that needed solving.

We still have quite a lot of urgent problems that needs urgent short and medium term solutions. We still have a chronic revenue crisis. More than two-thirds of Nigeria’s revenue go into debt servicing (our revenue-to-debts ratio is 96%). This is because over the years, because of a below optimum tax-to-GDP ratio, government had to increasingly resort to budget deficits to be able to function. 8 years ago, our tax-to-GDP ratio was around 3% – one of the lowest in the world. Today, it has considerably risen to 10.86% thanks to the efforts of FIRS under former President Muhammadu Buhari.

But even at 10.86%, Nigeria is still below the African average of 16%. That level of revenue cannot finance one-third of critical expenditure needs not to talk about debt servicing. A drastic reform is therefore needed to jerk up our revenue. President Bola Ahmed Tinubu was aware of such reforms from Day 1 and within weeks of his presidency set up a Tax and Fiscal Reforms Committee headed by a renown tax consultant, Taiwo Oyedele with far reaching mandate to find ways to increase Nigeria’s tax-to-GDP ratio to 18% within three years.

Already, the Committee has indicated that they are not proposing increases in taxes in any way, rather they want to streamline revenue collection and widen the tax net so that those not paying taxes currently or underpaying taxes will be made to pay their due taxes. They are also proposing the housing of the revenue collecting arms of many MDAs under one entity so as to improve efficiency of collection, reduce cost of revenue collection and most importantly refocus the attention of many of these agencies of government such as Customs, NIMASA, NCC, etc to face their core mandates.

These tax reforms will benefit the low income earners and small/medium scale businesses more because the Committee is looking to align with President Tinubu’s thinking of not taxing poverty. The vast majority of businesses in Nigeria (who are mostly MSMEs) would be exempted from paying taxes under this arrangement. That alone will be a big boost to the informal sector and has the capacity to significantly increase GDP growth.

Just yesterday, the new FIRS Chairman, Mr. Zacch Adedeji came on board. He has already set a target of 18% tax-to-GDP ratio within 36 months in line with expectations of the Tax and Fiscal Reforms Committee set up by the President. The federal government is planning an ambitious public spending across many sectors especially infrastructure-related sectors and it is common knowledge that we cannot make any headway if our national revenue does not significantly increase since we are approaching our self-imposed debt ceiling. Therefore, the tax reforms commissioned by President Bola Tinubu is actually Tinubunomics taking shape!