Nigeria’s foreign exchange market is experiencing a remarkable revival, achieving a groundbreaking $1 billion turnover in a single day. This milestone signals the end of prolonged dollar scarcity, opening doors to accelerated economic progress.

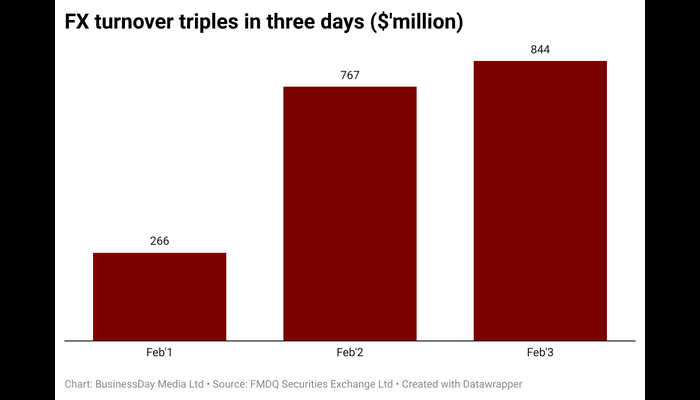

Turnover at Nigeria’s foreign exchange market jumped to the highest in a single day since 2017 on Tuesday, as a prolonged dollar shortage that has dampened economic activity for years gives way.

The Central Bank of Nigeria’s proactive reforms have played a pivotal role in this turnaround. By addressing the backlog of foreign exchange forwards and offering attractive interest rates on government securities, the CBN has enticed foreign portfolio investors and injected vitality into market liquidity. These strategic initiatives have not only bolstered investor confidence but also led to the consistent appreciation of the Nigerian Naira, reaching a three-month peak.

The renewed dynamism in the FX market is evident in the recent Treasury Bills auction, where demand for one year notes surged to unprecedented levels. This surge, largely fueled by foreign investors, underscores the global financial community’s renewed optimism in Nigeria’s economic trajectory.

As Nigeria progresses on its path of economic reform, the CBN’s commitment to sustaining these positive changes is paramount. With ongoing efforts, the nation can anticipate sustained market liquidity, currency stability, and overall economic growth.