Reactions have trailed the announcement by the Central Bank of Nigeria (CBN) directing banks and other financial institutions including mobile money operators to begin deduction of 0.5% Cybersecurity levy on some categories of electronic bank transfers effective 20th May, 2024.

The directive, the CBN said is in compliance with Section 44(2) (a) of the Cybercrimes (Prohibition, Prevention, etc) Amendment Act 2024. However, following the announcement by the apex Bank via its latest circular released on Monday, many Nigerians have taken to the social media to express their confusion and displeasure with the new CBN directive.

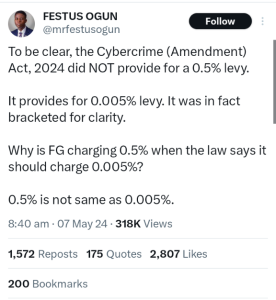

Some described the directive as unclear and wondered if all bank transactions were subject to the cybersecurity levy of 0.5% or 0.005 of the amount involved in the transaction.

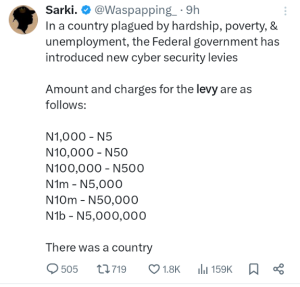

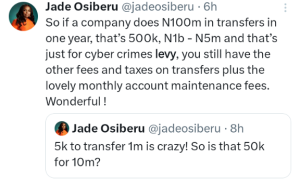

Others kicked against the introduction of the cybersecurity levy on the ground that it is going to further add to the burden of Nigerians and reduce their disposable incomes. An X user with the handle @Waspapping_ said, “In a country plagued by hardship, poverty, & unemployment, the Federal government has introduced new cyber security levies…”

Below are comments from some other X users…

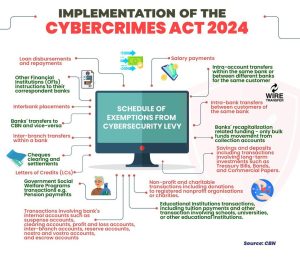

Amidst the uproar generated by the new cybersecurity levy, there appears to be some form of misinformation, which has forced the CBN to release graphical clarifications.

The CBN emphasised that contrary to misinformation in some quarters, the levy is not meant to be deducted from all transactions as there are many categories of transactions listed in the schedule attached to its circular, which are exempted from paying the cybersecurity levy. Some of these include:

1. Loan disbursements and repayments

2. Salary payments

3. Intra-account transfers within the same bank or between different banks for the same customer.

4. Intra-bank transfers between customers of the same bank.

5. Other financial institutions (OFIs) instructions to their correspondent banks.

6. Interbank placements.

7. Banks’ transfer to CBN and vice versa.

8. Inter-branch transfers within a bank.

9. Cheques clearing and settlements.

10. Letters of credit (LCs).

11. Banks’ recapitalisation related funding – only bulk funds movement from collection accounts.

12. Savings and deposits including transactions involving long-term investments such as treasury bills, bonds, and commercial papers.

13. Government social welfare programme transactions e.g. Pension payments.

14. Non-profit and charitable transactions including donations to registered non-profit organisations or charities.

15. Educational institutions transactions, including tuition payments and other transactions involving schools, universities, or other educational institutions.

16. Transactions involving bank’s internal accounts such as suspense accounts, clearing accounts, profit and loss accounts, inter-branch accounts, reserve accounts, nostro and vostro accounts, and escrow accounts.