Presidential candidate of the Labour Party, Mr. Peter Obi, has come under fresh scrutiny after a petition alleging fraudulent practice and illegal falsification of accounts at Fidelity Bank whilst he chaired the board of the financial institution surfaced on Tuesday.

Obi was appointed the youngest chairperson of Fidelity Bank in the 2000s and helped prepare the bank for the recapitalization carried out by the Central Bank of Nigeria (CBN) beginning in 2005 when it was discovered that several banks operating in the country at the time lacked stability and suffered corrupt and non-transparent corporate culture in which management indulged in questionable loans and distribution of deposits to friends and cronies.

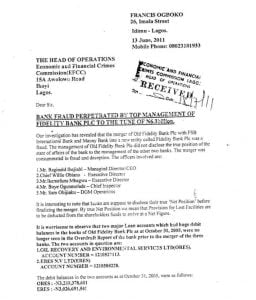

Although Obi maintains that his conduct at Fidelity Bank was above board before his resignation to pursue a governorship ambition in Anambra, a petition addressed to the EFCC in 2011 alleging ‘bank fraud perpetrated by the top management of Fidelity Bank Plc to the tune of N6.35BN’ under Obi’s chairmanship has undercut the claim and raised fresh questions on his moral fitness to hold the presidency.

The petition seen by Podium Reporters was authored by one Francis Ogboko and it detailed an investigation that “revealed that the merger of Old Fidelity Bank Plc with FSB International Bank and Manny Bank into a new entity called Fidelity Bank Plc was a fraud.”

According to him, “the management of Old Fidelity Bank Plc did not disclose the true position of the state of affairs of the bank to the management of the other two banks. The merger was consummated in fraud and deception.”

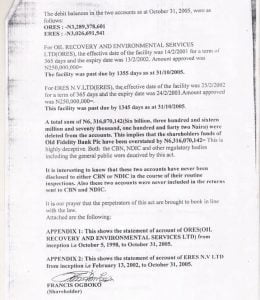

He claimed that “a total sum of N6,316,070,142 (Six billion, three hundred and sixteen million and seventy thousand, one hundred and forty-two naira) were deleted from the accounts. This implies that the shareholders’ funds of Old Fidelity Bank Plc have been overstated by N6,316,070,142. This is highly deceptive. Both the CBN, NDIC and other regulatory bodies including the general public were deceived by this act.”

See the document below:

The fresh allegation adds to the cloud of corruption around Peter Obi as he contends for the presidency. Last year, a PREMIUM TIMES investigation based on the PANDORA PAPERS revealed the multiple offshore companies, accounts and properties maintained by Obi to circumvent regulation and transparent accounting.

According to the report, Obi admitted that he did not declare “these companies and the funds and properties they hold in his asset declaration filings with the Code of Conduct Bureau, the Nigerian government agency that deals with the issues of corruption, conflict of interest, and abuse of office by public servants.

He also faced public anger and legislative inquiry in 2009 when his aide was caught in Lagos with N250 million in cash. The sum was purportedly meant for a contractor, although it remained unclear why it had to be ferried in cash.